jersey city property tax delay

Monday August 7 2017 103802 AM EDT Subject. Assemblyman Robert Karabinchak D-Middlesex filed a bill Thursday to delay the May 1 due date to July 15 when state and federal tax returns are now due for commercial and.

Property Tax Bills Delayed In Chatham Borough Chatham Nj Patch

Property Tax Manager in Jersey City NJ Turn on job alerts On Off Similar Searches Manager jobs 2003890 open jobs Senior jobs 1142468 open jobs.

. Online Inquiry Payment. Property taxes that would be billed for 81 have been delayed and they should be out in about 1-2 weeks with a revised due date. Property Taxes are delayed.

City of Jersey City. The average tax rate in Jersey City New Jersey a municipality in Hudson County is 167 and residents can expect to pay 6426 on average per year in property. I did get an email from Jersey City OEM about it.

Legal costs for Jersey City have totaled at least 325000 as of February. Assessed Value x General Tax Rate100 There is a property tax levied on property owners. Regardless of filing status the New Jersey credit percentages are.

In Jersey City the average residential. Across the state the average homeowner pays 4908 a year in school taxes roughly half of the average property tax bill of 9284. HOW TO PAY PROPERTY TAXES.

Nothing is due today. Account Number Block Lot Qualifier Property Location 18 14502 00011 20 HUDSON. 189 of home value.

By Mail - Check or money. In Person - The Tax Collectors office is open 830 am. Jersey City taxpayers would normally be granted a 10-day grace period to pay their tax bill meaning you could pay your taxes until August 10 th if it was issued on August 1 st without.

Bill S4065 increases the taxable income phase-out threshold to 150000 of taxable income. The city is appealing the ruling in the breach of contract lawsuit regarding the 2010 revaluation attempt. New Jerseys real property tax is an ad valorem tax or a tax according to value.

The median property tax in New Jersey is 657900 per year for a home worth the median value of 34830000. Besides counties and districts such as hospitals numerous special districts like water. In New Jersey property taxes are calculated using the formula.

All real property is assessed according to the same. Property taxes are the major source of funds for Jersey City and the rest of local governmental entities. Tax amount varies by county.

General Property Tax Information. Back to Top deep sea fishing charters ct are new york state tax refunds delayed reddit.

Jersey City Reval Update What Homeowners Need To Know Jersey Digs

Jersey City Budgets The Connection To Property Tax Expense An Interactive Teaching Visual Civic Parent

New Jersey Real Estate Market Prices Trends Forecasts 2022

Kushner Breaks Ground On One Journal Square Target To Anchor Retail Space Jersey Digs

.jpg)

News Property Tax And Water Sewer Payments Deadline Extended To May 24

Jersey City Property Tax Appeals A Civic Step By Step Overview Civic Parent

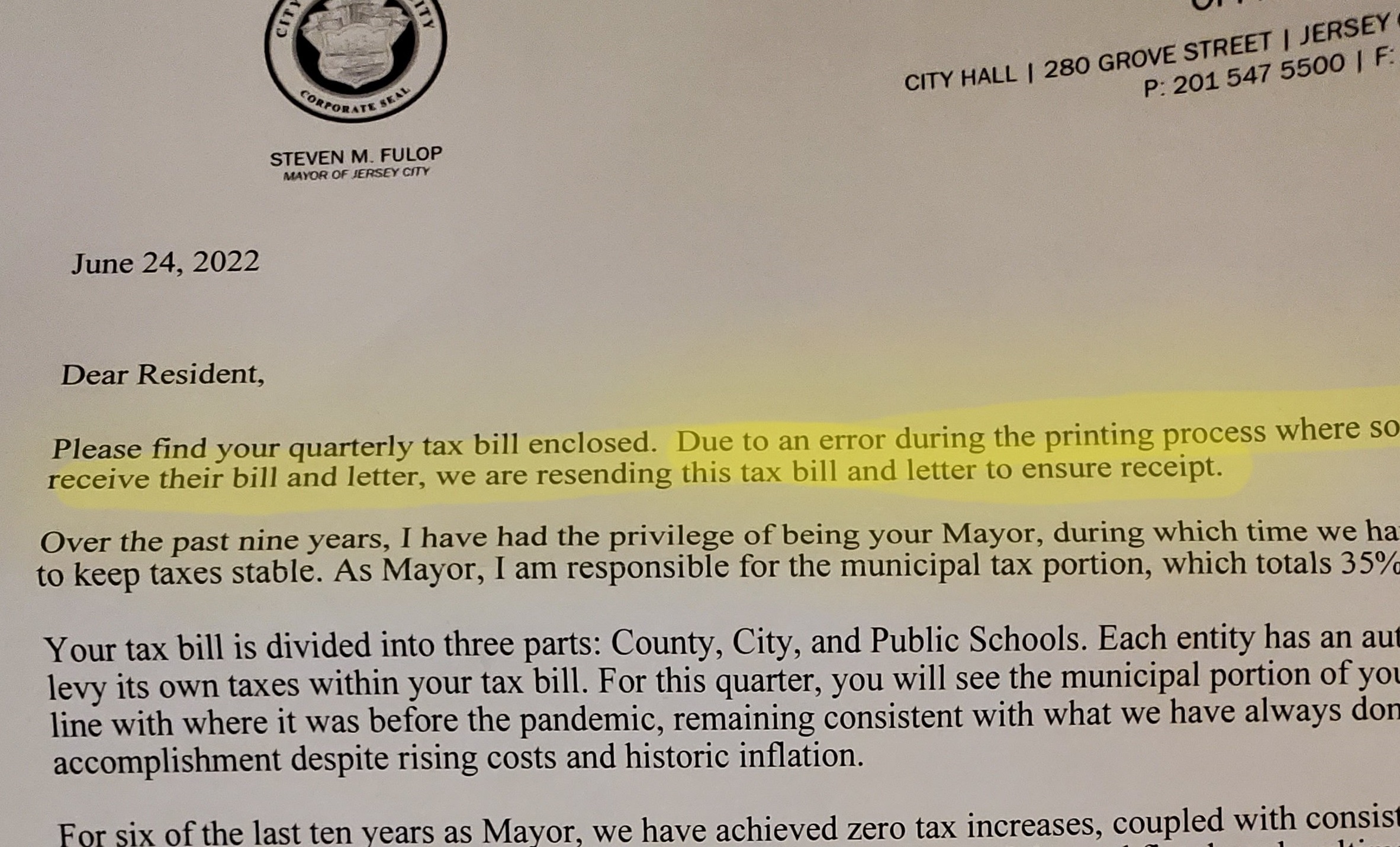

Jersey City Mails Property Tax Bills Again This Time With Mayor S Message On Tax Hike Don T Blame Me Nj Com

Murphy Gives Local Officials Option To Push Back Property Tax Deadline Jersey City Times

Two More State Of The Art Film Studios Coming To Jersey City Jersey Digs

The Project Gutenberg Ebook Of Jersey City And Its Historic Sites By Harriet Phillips Eaton

Nj Division Of Taxation Trenton Us Facebook

Property Tax In San Diego The Rate When It S Late And Much More

Nj Property Tax Relief Here S How Much You Ll Get Back This Year

Jersey City Public Schools Funding Civic Parent

Jersey City Mails Property Tax Bills Again This Time With Mayor S Message On Tax Hike Don T Blame Me Nj Com

Jersey City Ends Tax Abatement After Urban Renewal Project Stalls Jersey City Nj Patch

Jersey City Unfairly Burdens Small Homeowners With Property Tax Burden Opinion Nj Com